CLIENT INFORMATION

CreditLine is the first online loan service in which the vehicle remains in the ownership and use of its owner, as before.

The company has been operating since 2010 and during this time has accumulated solid experience in providing micro loans secured by a car, has reduced the conditions and time for processing micro loans to a minimum.

TASKS WITH WHICH THE CLIENT CAME WITH

Prior to contacting us, the company used Excel to maintain a customer database, there were no records of managers' conversations, and all communications with customers went through personal WhatsApp.

The manager could not track and control the conduct of transactions. It was not possible to send out mailings to the customer base and inform them about payments in a timely manner.

Contracts with clients, scans of documents, photos of collateral were stored on a shared drive and created additional problems with finding and organizing information.

All these processes needed to be automated and the best solution for this is to switch to Bitrix24

IMPLEMENTATION PROCESS, PROJECT FEATURES

We analyzed the company's processes and drew up a roadmap for solving the set tasks.

We installed the boxed version of Bitrix24 and, first of all, set up the integration of the portal with the site and telephony, thanks to which all requests are centrally collected in Bitrix24 in the form of leads.

Further, we automated the processes of issuing and repaying a loan and completely transferred the work of managers with clients to the portal. Set up rejection reasons in deals and leads. For example, the reason "High interest on the loan" gives rise to the analysis of the proposed conditions of the company in comparison with competitors.

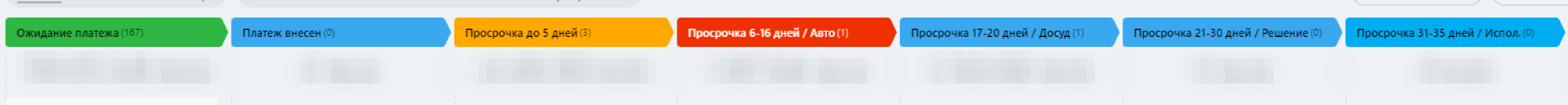

We added a customer database and statuses on overdue payments, as well as set up automatic delivery of notifications to the client about payments and debts.

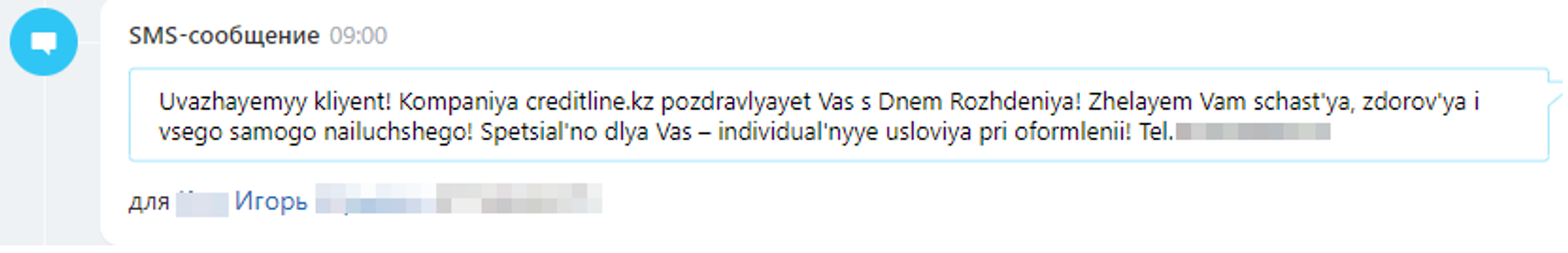

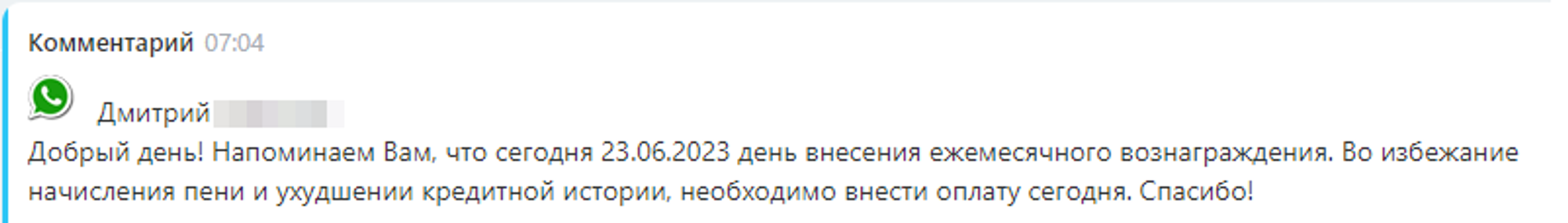

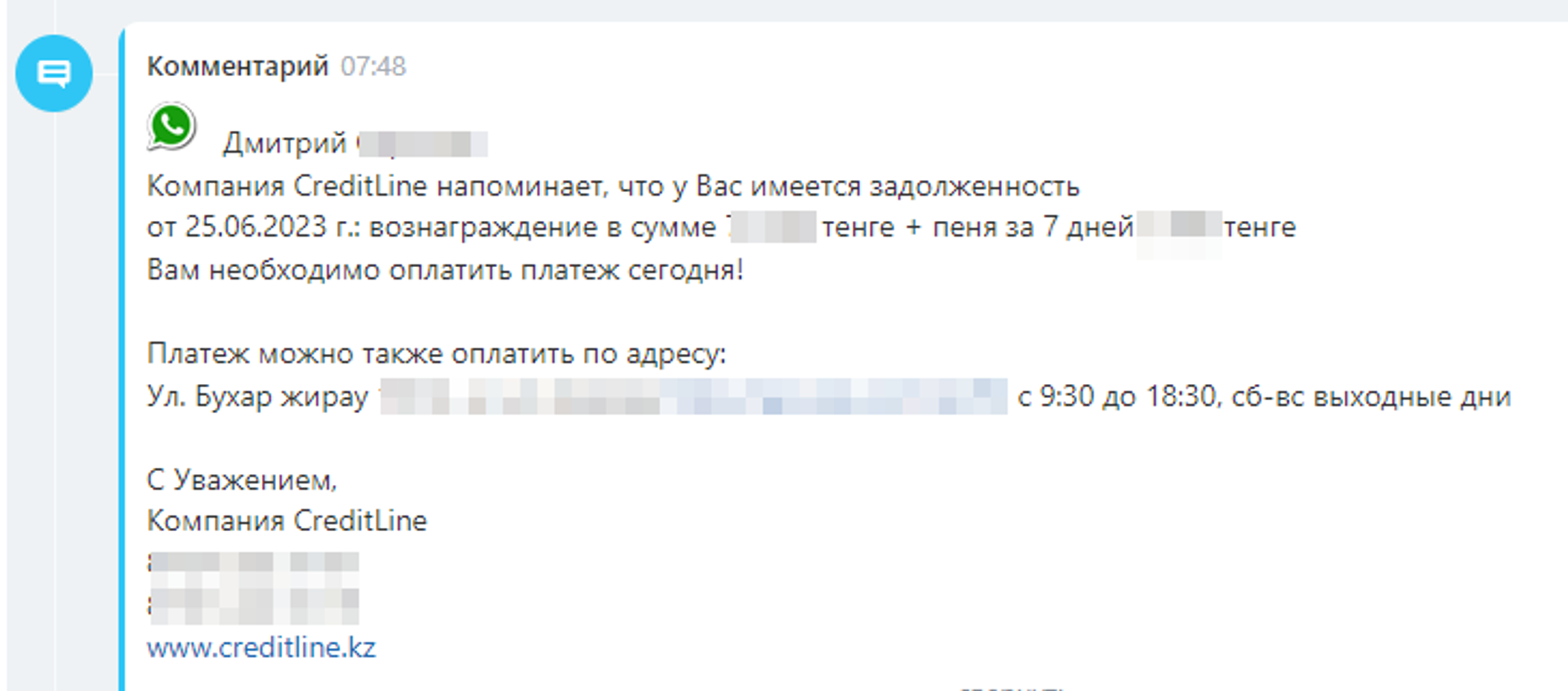

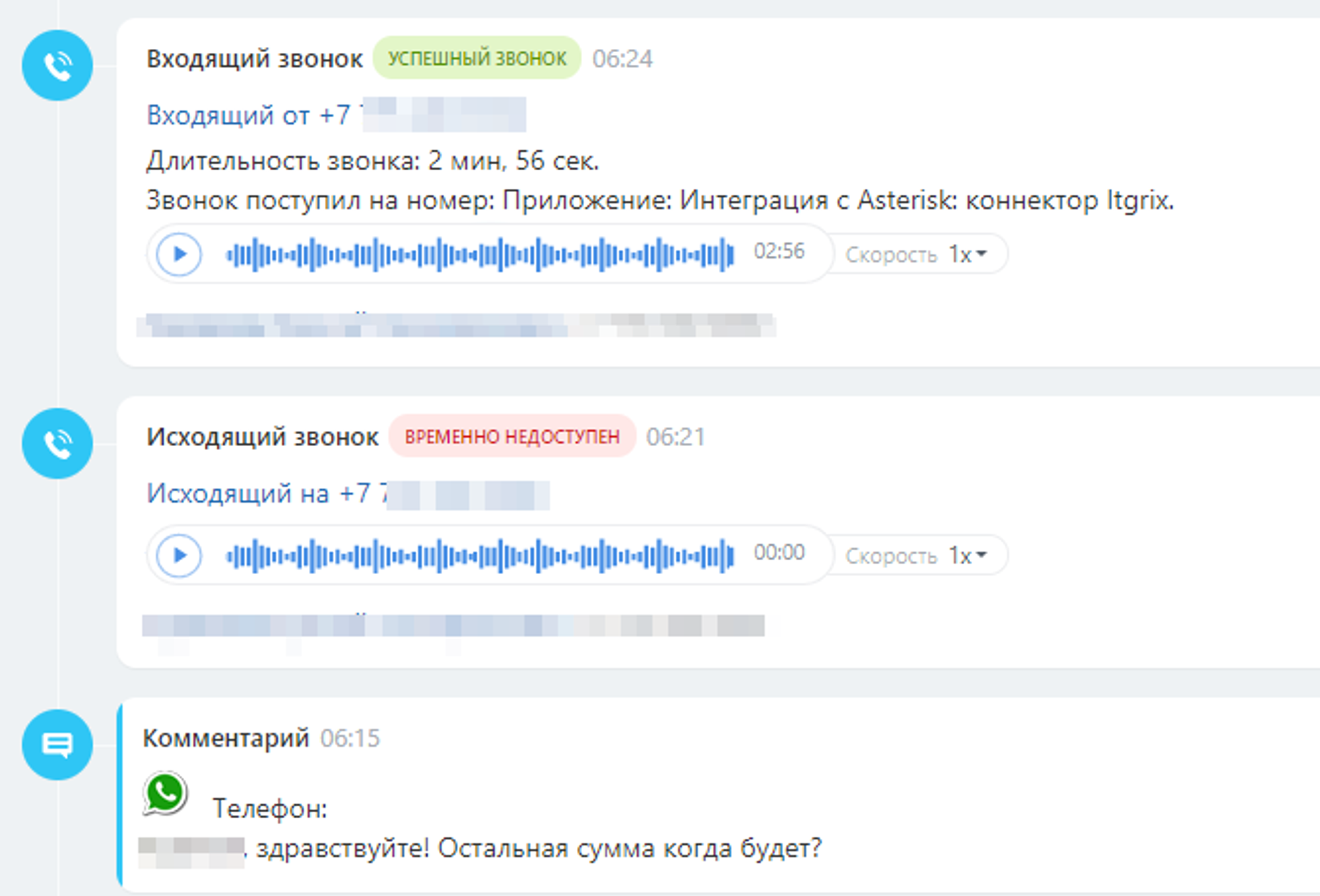

We connected the SMS mailing service and Whatsapp for receiving applications and interaction between managers and clients, including setting up automatic mailing of birthday greetings.

WORKING WITH THE SOLUTION. RESULTS ACHIEVED

Thanks to the implementation of Bitrix24, all work with the client is carried out in a single window as transparently and conveniently as possible for all participants in the transaction (managers, legal department and head).

Customer request

The client leaves an application for a loan. This can be done via:

- special forms on the site;

- WhatsApp;

- call;

- callback order;

- personal account on the site.

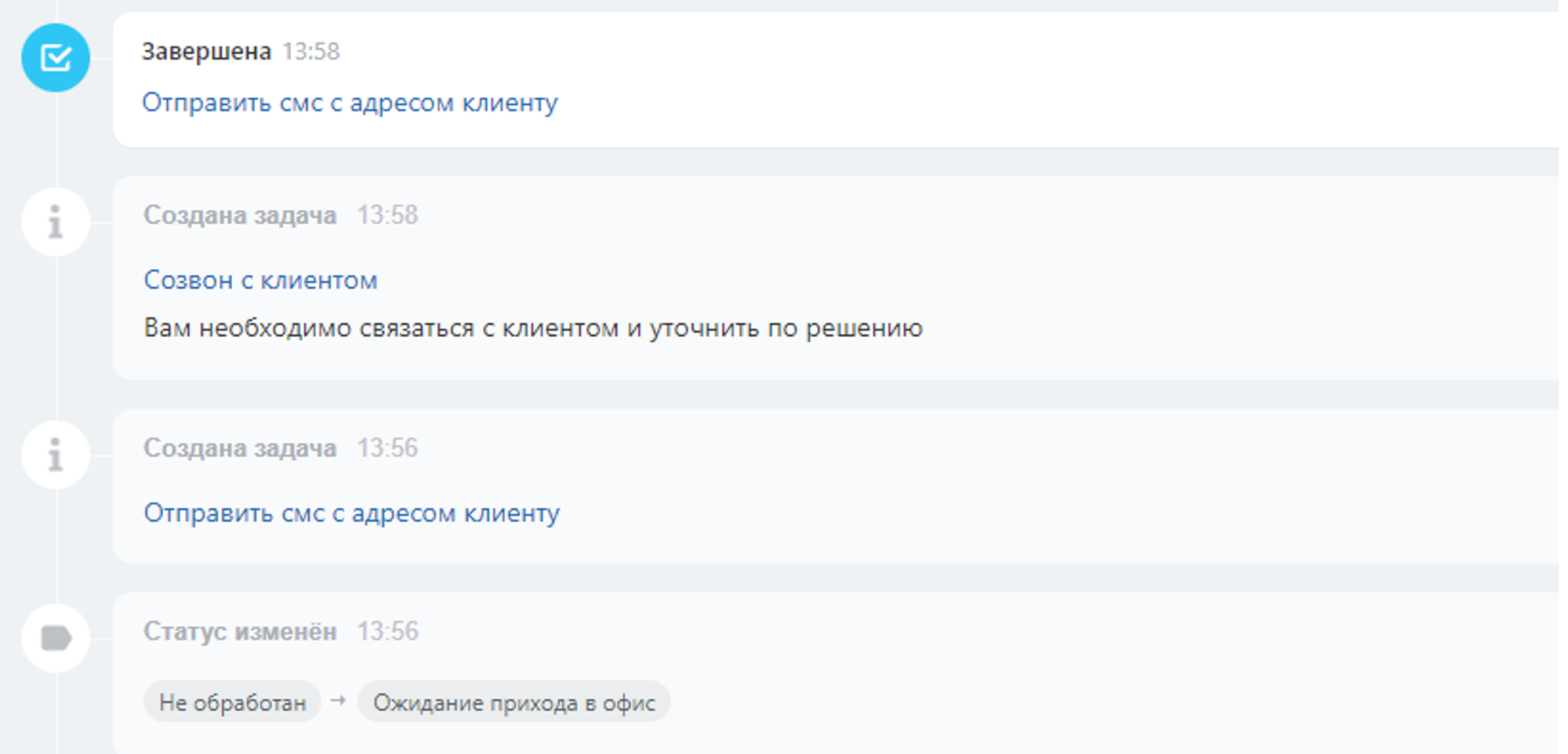

The application enters the Bitrix24 portal in the Lead card at the “Not processed” stage. The manager takes the request and contacts the client, transferring the transaction to the stage “In progress”.

Since this is a chain of pawnshops, the company has several offices. The manager makes an appointment with the client, and after the conversation, the client is automatically sent an SMS with the office address and the date of the meeting.

The whole story is recorded in the Lead card.

Issuance of a loan

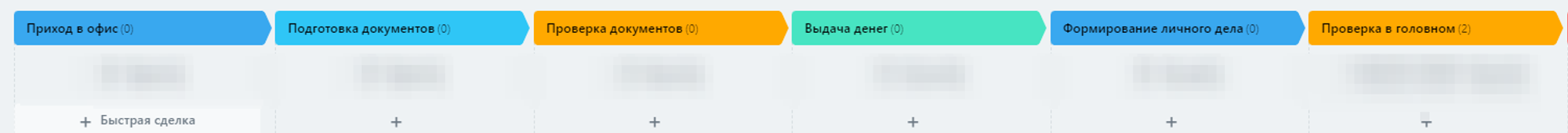

After the client arrives at the office, the manager creates a deal in the directionIssuance of a loanand then all communication with the client will be conducted in it at the appropriate stages.

- Arrival at the office

- Preparation of documents

- Verification of documents

- Payment of the money

- Formation of a personal file

- Head office check

- Transaction successful/failed

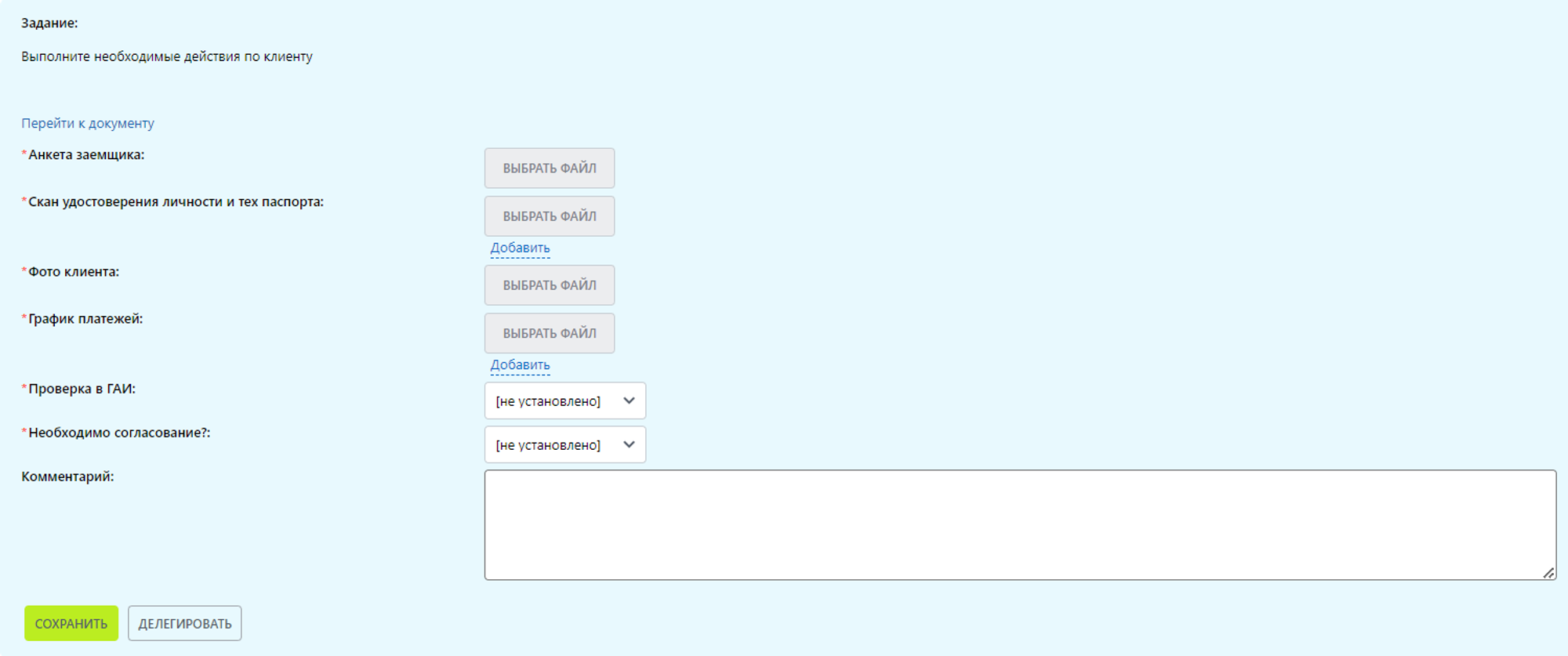

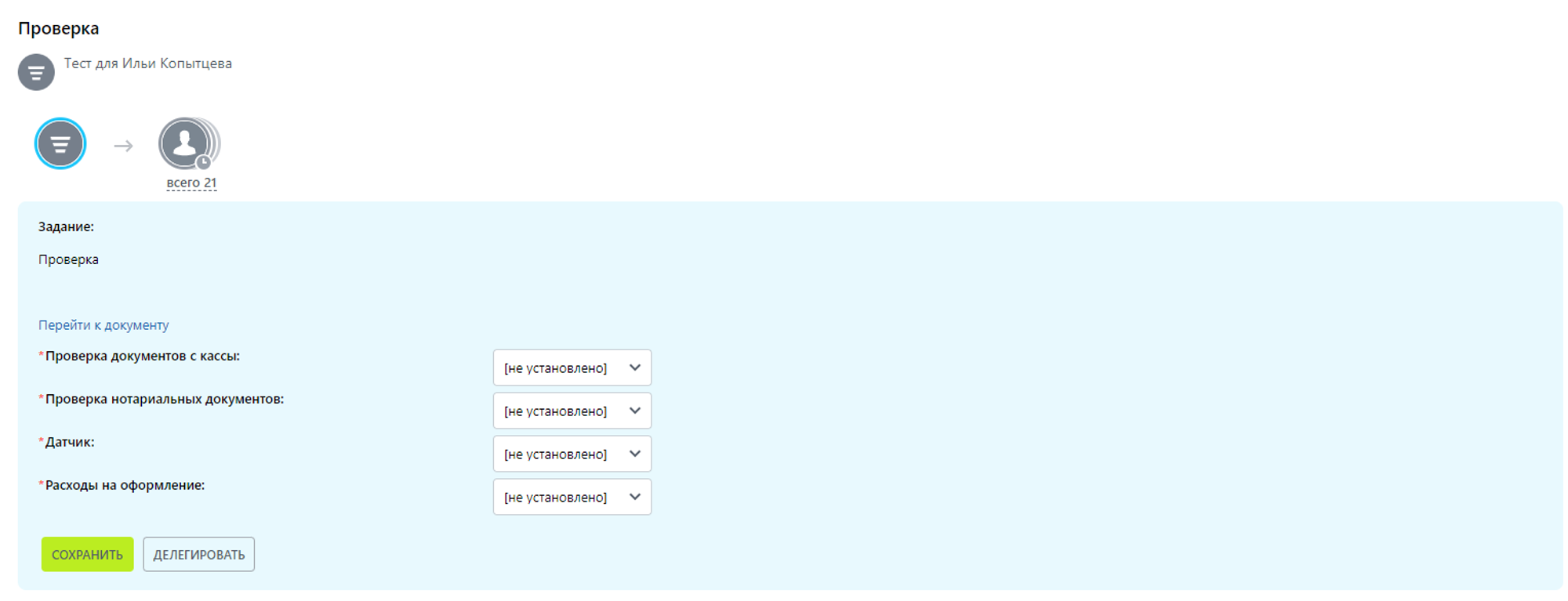

At each stage, a separate process is launched, where the manager needs to enter data and upload client documents. Stages move automatically after filling in all the fields and completing the corresponding task.

Preparation of documents:

Verification of documents:

After filling in all the documents, data and their verification, the information is automatically transferred to 1C and the task is set to issue money.

Loan repayment

After the loan is issued, a deal is created in the funnelLoan return. There from 1C it is formedpayment schedule and amountsand also configuredthe process of notifying customers about payment and checking the fact of payments

Notify customers via WhatsApp

If payments are made by the client on time, then the process is cyclically repeated until the entire loan is paid by the client, after which it is successfully completed.

If, for some reason, the amount was not paid on time, notifications are sent to the client, and the manager additionally contacts to clarify when the next payment will be made.

If the payment is overdue for a long period, then the legal department is connected, pre-trial documents are formed.

ADVANTAGES FROM IMPLEMENTATION

Managers, lawyers and the manager work on the Bitrix24 portal.

The manager does not need to think about what information at what stage needs to be filled in or requested, the system will prompt everything itself.

Lawyers are automatically involved in transactions when there is a clear delay in payment and the situation requires their intervention.

The manager monitors the entire process of work and controls the conduct of transactions.

All communication channels are digitized, which guarantees the receipt of all applications, it is also clear at what stage of the transaction each client is.

400-500 loan applications are processed monthly, of which 20-40 loans are issued. 150-200 clients are informed about payment terms and delays. Thanks to automatic notifications, manual work is completely excluded, all messages are sent on time.